Magazine

Do You Thrive To Learn More About How To Achieve Greater Business Success?

Sign up to our magazine designed specifically for Australian business leaders.

You are here: Home » Blog » Accounting » Division 7A Mess Up Series – Part Two: The All-Too-Often Overlooked Hurdle with Division 7A Sub-trusts

Published on 25 February 2020

Categories: Accounting

Over the last decade accountants on behalf of their clients have had to deal with the UPE issue.

When a trust makes a company entitled to income but does not actually transfer the money to the company to clear out the entitlement, this is called an “unpaid present entitlement” (UPE). If a UPE persists then to avoid adverse tax outcomes what generally needs to happen is for that UPE to be converted to a complying Division 7A loan or a complying subtrust arrangement.

If the UPE is put on a complying Division 7A loan – (put simpler than it actually is) a 7 year loan requiring minimum repayments at the ATO’s stipulated interest rate – then everything should be ok.

However, not everyone is keen to convert a UPE to a complying Division 7A loan (totally understandable) and instead opt to use a complying subtrust arrangement. These subtrust arrangements can work brilliantly but all loans and UPEs across the group of companies, trusts and individuals must be very carefully monitored.

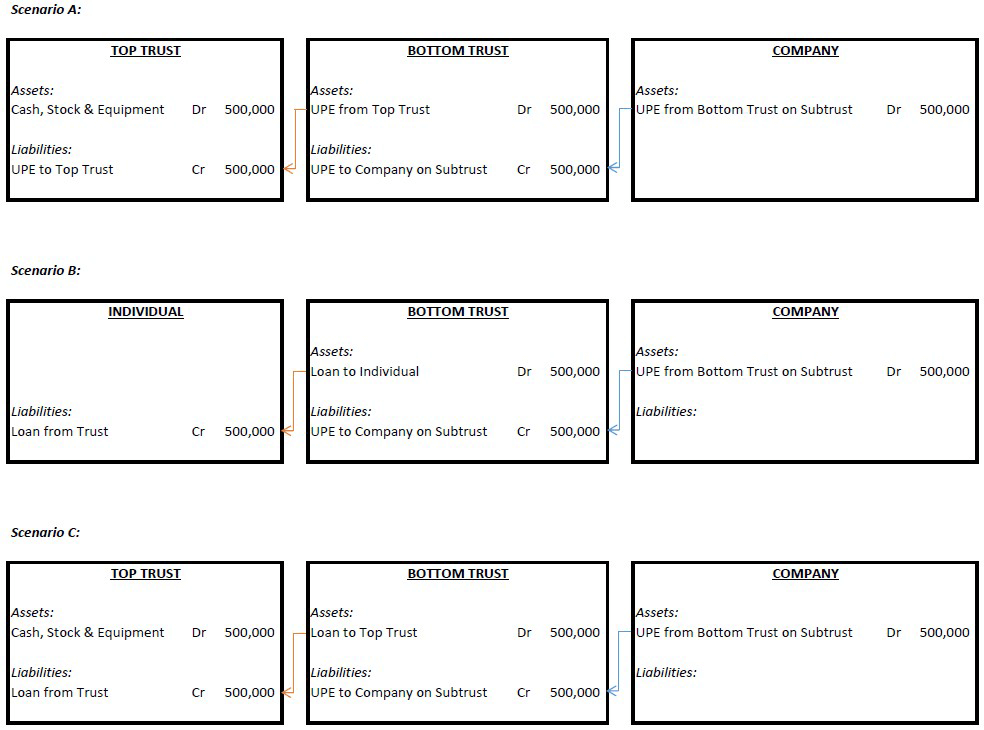

What we’ve unfortunately seen happen when clients come to us from other accountants is a failure to look beyond this first stage of trust to company unpaid present entitlement. If the first trust to company UPE is put on subtrust then that gets a tick✔. Next we must move up the change of entities to the trust to see if it has an unpaid present entitlement owing to it, or if it has lent out funds to another trust or individual. If so, then PAY CLOSE ATTENTION.

IT IS NOT GOOD ENOUGH to do nothing with that higher up UPE or loan. There is oftentimes a very real possibility that the rules of Division 7A will trigger a deemed dividend even though the first trust to company UPE is satisfying the ATO’s subtrust conditions.

In other words, if your group’s balance sheets look something like this, you’re in the danger zone.

If you’ve encountered any of these issues or are concerned about how your accountant has handled your Division 7A compliance, then give either Mike Beer or Ben Paul a call to obtain the specialist Division 7A help you need.

For more Division 7A Mess Ups see Part One, Part Three and Part Four.

Do You Thrive To Learn More About How To Achieve Greater Business Success?

Sign up to our magazine designed specifically for Australian business leaders.